Our Top 10 Picks – Best LLC Formation Services (2025)

1. (Visit) Northwest Registered Agent (Editor’s Choice)

Northwest Registered Agent – LLC Formation Overview

1. LLC Formation Service

-

Flat Fee: $39 plus your state filing fees.

Includes preparation and filing of your Articles of Organization. -

State fees vary by jurisdiction and are not included in the $39 base price.

2. Registered Agent Service

-

First year: Free when you use Northwest to form your LLC.

-

After the first year: $125 per year, consistently priced with no surprise increases.

3. What’s Included with LLC Formation

-

Free 1-year Registered Agent service (as noted above).

-

Custom-drafted formation documents: Articles of Organization, initial resolutions, Operating Agreement or bylaws, LLC membership certificate/corporation stock certificate.

-

Online dashboard to access your documents and filing tools.

-

A dedicated “Corporate Guide®” for personalized support throughout the process.

4. Optional Add-On Services

These are offered a la carte, each with its own pricing:

-

EIN (Employer Identification Number): $50 (U.S. SSN holders); $200 (non-U.S. residents or those without SSN).

-

Annual Report Filing: $100/year (plus state fees).

-

S-Corp Election: $50.

-

Mail Forwarding: $40/month.

-

Virtual Office Service: $49/month.

-

Business Phone Number: $9/month.

-

Certificate of Good Standing, Corporate Book, Seal: Costs vary (e.g. binder book $80, GoBook $40, seal $30).

-

International Formation (for non-U.S. residents):

-

Option 1: $925 — includes company formation, registered agent service, EIN, unlimited mail scanning, unique business address, and office lease.

-

Option 2: $1,425 — Option 1 plus certified copies, apostille, and certificate of incumbency.

-

5. Privacy & Support Features

Northwest emphasizes privacy and personalized support:

-

Privacy by Default® — they list their business address on filings instead of yours, and they do not sell your data.

-

Corporate Guides® — real in-house experts available via phone/email (no sales scripts or automated voices).

-

Free Limited Mail Forwarding — up to 5 documents per year.

-

Same-day scans of documents they receive.

Quick Summary Table

| Service/Package | Price (plus state fees) |

|---|---|

| LLC Formation | $39 one-time |

| Registered Agent (year 2+) | $125/year |

| EIN Application | $50 (US SSN) / $200 (non-US) |

| Annual Report Filing | $100/year |

| S-Corp Election | $50 |

| Mail Forwarding | $40/month |

| Virtual Office | $49/month |

| Additional Business Phone Line | $9/month |

| Corporate Book/Seal | $40-$80 (book), $30 (seal) |

| International Formation Options | $925 / $1,425 |

Bottom Line

Northwest Registered Agent keeps LLC formation straightforward with a $39 base fee (plus state costs) that includes one year of registered agent services and essential formation documents.

From there, you can add only the services you need—such as EIN, mail forwarding, or virtual office—without forced bundles or upsells.

Their focus on privacy, expert guidance, and fair renewal rates makes them a standout for entrepreneurs who value transparency and support.

- Free website domain

- Business website & hosting with SSL security

- Business email address

- Privacy by Default®

- In Business for 27 years

- Trusted by 3 Million Businesses

Free Registered Agent (1 Year) With $39 LLC formation when you use our discount link

![]()

Bizee LLC Formation Plans & Pricing

-

Silver (Basic) Package: $0 (plus your state filing fee)

-

Includes preparation and filing of Articles of Organization, a business name availability check, an online dashboard, one year of registered agent service, unlimited email/phone support, business tax consultation, compliance alerts, and more.

-

-

Gold (Standard) Package: $199 (plus your state filing fee)

-

Includes everything in the Silver package, plus EIN registration, Operating Agreement, Banking Resolution, IRS Form 2553 (S-Corp election), business bank account assistance, and lifetime compliance alerts.

-

-

Platinum (Premium) Package: $299 (plus your state filing fee)

-

Includes all Gold-level features plus business contract templates, expedited filing service, a business domain name, business email address, and a website.

-

So in summary:

-

Silver (Basic): $0 + state filing fee (Articles of Organization, 1-year registered agent, dashboard, support, tax consultation, compliance alerts)

-

Gold (Standard): $199 + state filing fee (All Silver features + EIN, Operating Agreement, Banking Resolution, IRS Form 2553, business bank assistance)

-

Platinum (Premium): $299 + state filing fee (All Gold features + contract templates, expedited filing, domain, email, website)

3. ZenBusiness

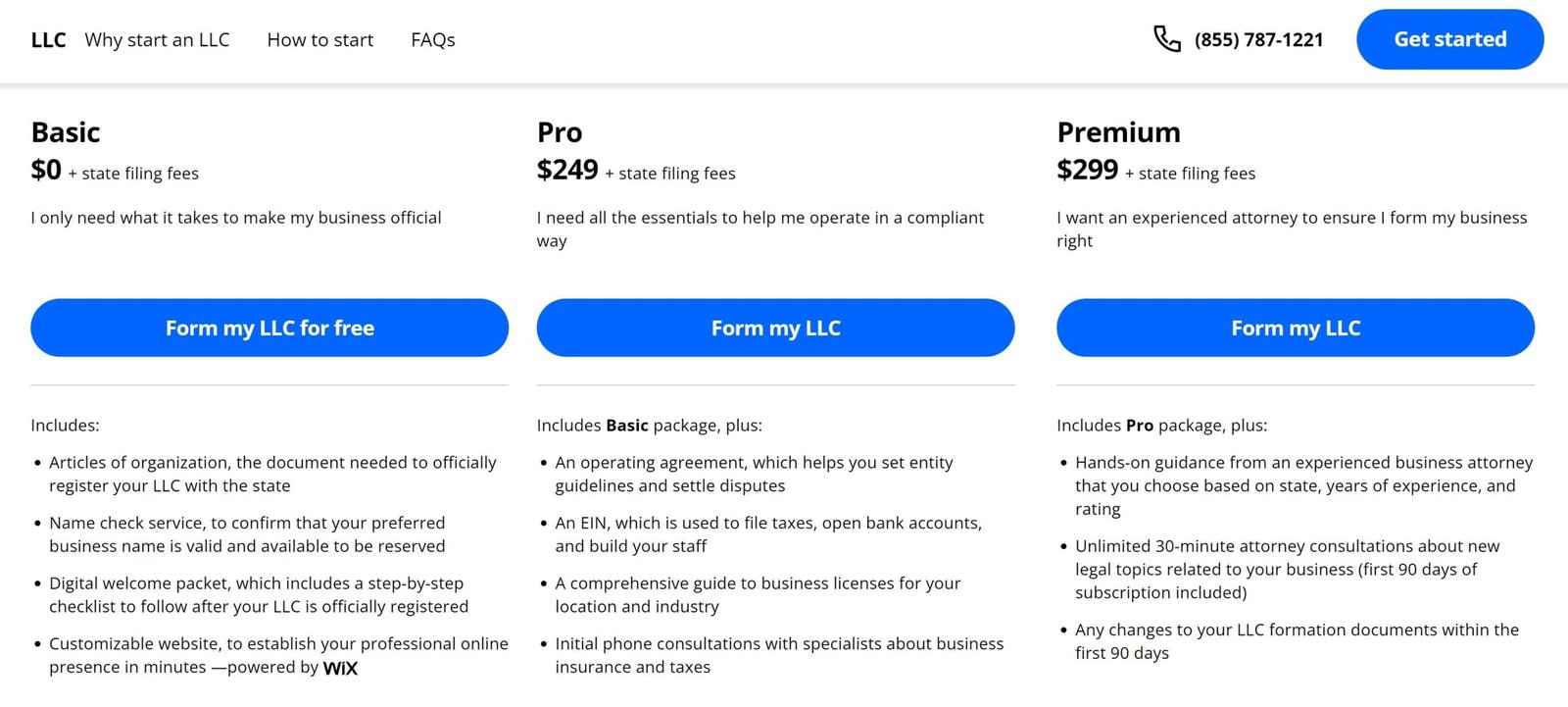

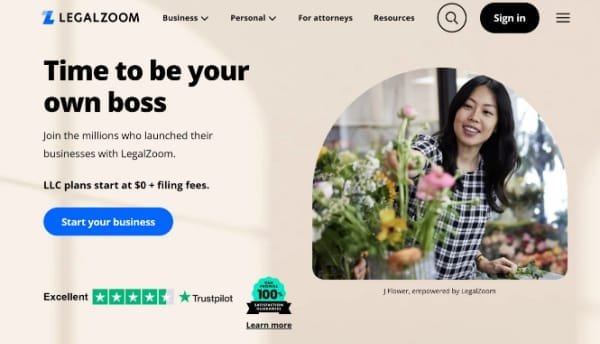

4. LegalZoom

5. Swyftfilings

6. Inc Authority

7. BetterLegal

8. Rocket Lawyer

9. Active Filings

10. Harbor Compliance

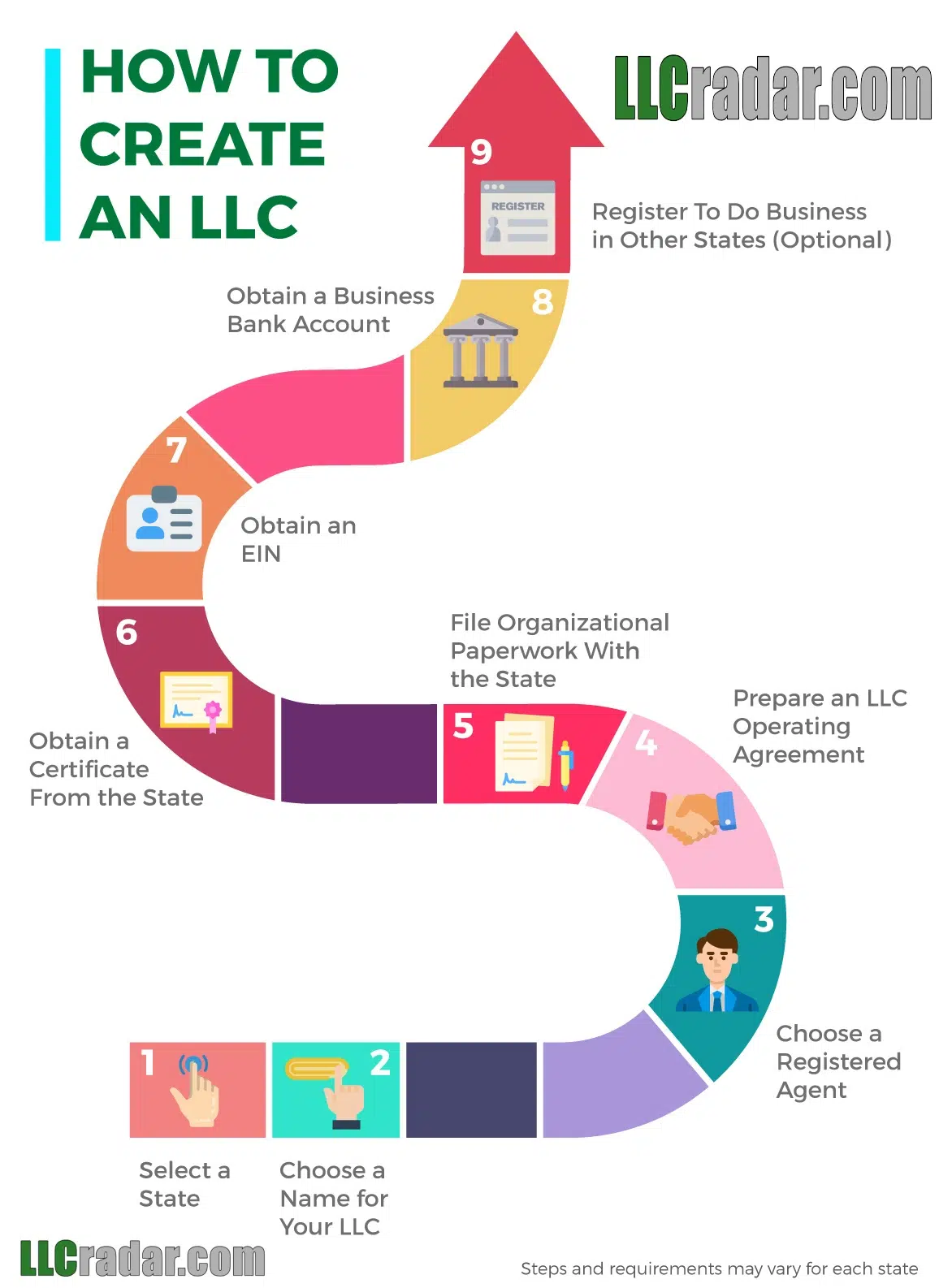

How to Create an LLC in 9 Steps

Step 1: Select a State

Step 2: Choose a Name for Your LLC

Step 3: Choose a Registered Agent

Step 4: Prepare an LLC Operating Agreement

Step 5: File the Organizational Paperwork with the State

Step 6: Obtain a Certificate from the State

Step 7: Obtain an EIN (Employer ID Number)

Step 8: Open a Business Bank Account

Step 9: Register to Do Business in Another State (Optional)

Step 1: Choose a Business Name

The first step in forming your LLC is deciding on a name for your business. Your business name should not only reflect your brand but also comply with your state’s LLC naming rules.

Most states require the name to include “Limited Liability Company” or an abbreviation like “LLC” or “L.L.C.”

Additionally, the name cannot include restricted words like “Bank” or “Insurance” unless you have proper authorization.

Before settling on a name, make sure it’s unique and not already in use by another business in your state. You can usually check this through your state’s business database online.

It’s also a good idea to verify if the domain name is available if you plan to create a website for your LLC.

Once you’ve chosen a compliant and unique name, consider reserving it with your state if you’re not ready to file your LLC documents right away.

Step 2: Designate a Registered Agent

Every LLC is required to have a registered agent—a person or entity authorized to receive legal documents and government notices on behalf of the company.

The registered agent acts as the official point of contact for the business, ensuring important communications like tax notifications or lawsuits are handled promptly.

Your registered agent can be an individual (such as yourself or another member of the LLC) or a professional service that specializes in handling this role.

To qualify, the agent must have a physical address in the state where your LLC is registered and be available during regular business hours.

Hiring a professional registered agent service can offer added convenience and privacy, especially if you prefer not to list your personal address on public records.

Step 3: File Articles of Organization

The next step in forming your LLC is filing the Articles of Organization (sometimes called a Certificate of Formation, depending on the state).

This document officially registers your LLC with the state and includes essential details about your business, such as its name, address, and the name of your registered agent.

You can typically file the Articles of Organization online, by mail, or in person with your state’s business filing office.

Be prepared to pay a filing fee, which varies by state but generally ranges from $50 to $500. After filing, most states will provide you with a confirmation or certificate of formation, which you should keep in your business records.

Step 4: Create an Operating Agreement (Optional but Recommended)

Although not always required by law, drafting an Operating Agreement is highly recommended.

This internal document outlines how your LLC will operate and defines the roles and responsibilities of its members.

It’s particularly important if your LLC has multiple owners, as it helps prevent disputes and clarifies expectations.

An Operating Agreement typically includes:

-

The ownership percentages of each member.

-

How profits and losses will be distributed.

-

Management structure (e.g., member-managed or manager-managed).

-

Procedures for adding or removing members.

-

Steps for dissolving the LLC if needed.

Even for single-member LLCs, having an Operating Agreement can establish a clear separation between your personal and business activities, reinforcing the liability protection offered by an LLC.

Step 5: Obtain an EIN (Employer Identification Number)

An Employer Identification Number (EIN) is a unique identifier for your business, issued by the IRS.

It’s necessary for a variety of purposes, including filing taxes, hiring employees, and opening a business bank account.

Obtaining an EIN is simple and free. You can apply directly through the IRS website, or by mailing or faxing Form SS-4.

Once you receive your EIN, be sure to keep it on file—it’s an essential piece of information you’ll need to manage your LLC’s finances and tax obligations.

Step 6: Fulfill State and Local Requirements

Depending on your state and industry, you may need to meet additional requirements after forming your LLC. Common requirements include:

-

Obtaining business licenses or permits specific to your industry.

-

Registering for state taxes, such as sales tax or employer taxes, if applicable.

-

Complying with zoning regulations for your business location.

Check with your state’s business office and local government to ensure you’re meeting all necessary requirements. Staying compliant will help you avoid penalties and keep your business running smoothly.

Step 7: Open a Business Bank Account

Opening a business bank account is a crucial step for keeping your personal and business finances separate.

This separation protects your personal assets, simplifies bookkeeping, and establishes credibility with customers and vendors.

To open a business bank account, you’ll typically need the following:

-

Your LLC’s EIN.

-

A copy of your Articles of Organization.

-

The Operating Agreement, if applicable.

Many banks offer specialized accounts for small businesses, so take the time to compare options and choose one that fits your needs.

Step 8: Maintain Your LLC

Once your LLC is formed, it’s essential to keep it in good standing by fulfilling ongoing obligations. These often include:

-

Filing annual or biennial reports with the state.

-

Paying state maintenance fees or franchise taxes.

-

Keeping accurate financial records and documentation.

-

Ensuring compliance with tax obligations at the state and federal levels.

Additionally, make sure to update your Articles of Organization if your business address, registered agent, or management structure changes.

Proactively managing these responsibilities ensures your LLC remains legally compliant and operational.

Step 9: (Optional) Register to Do Business in Another State

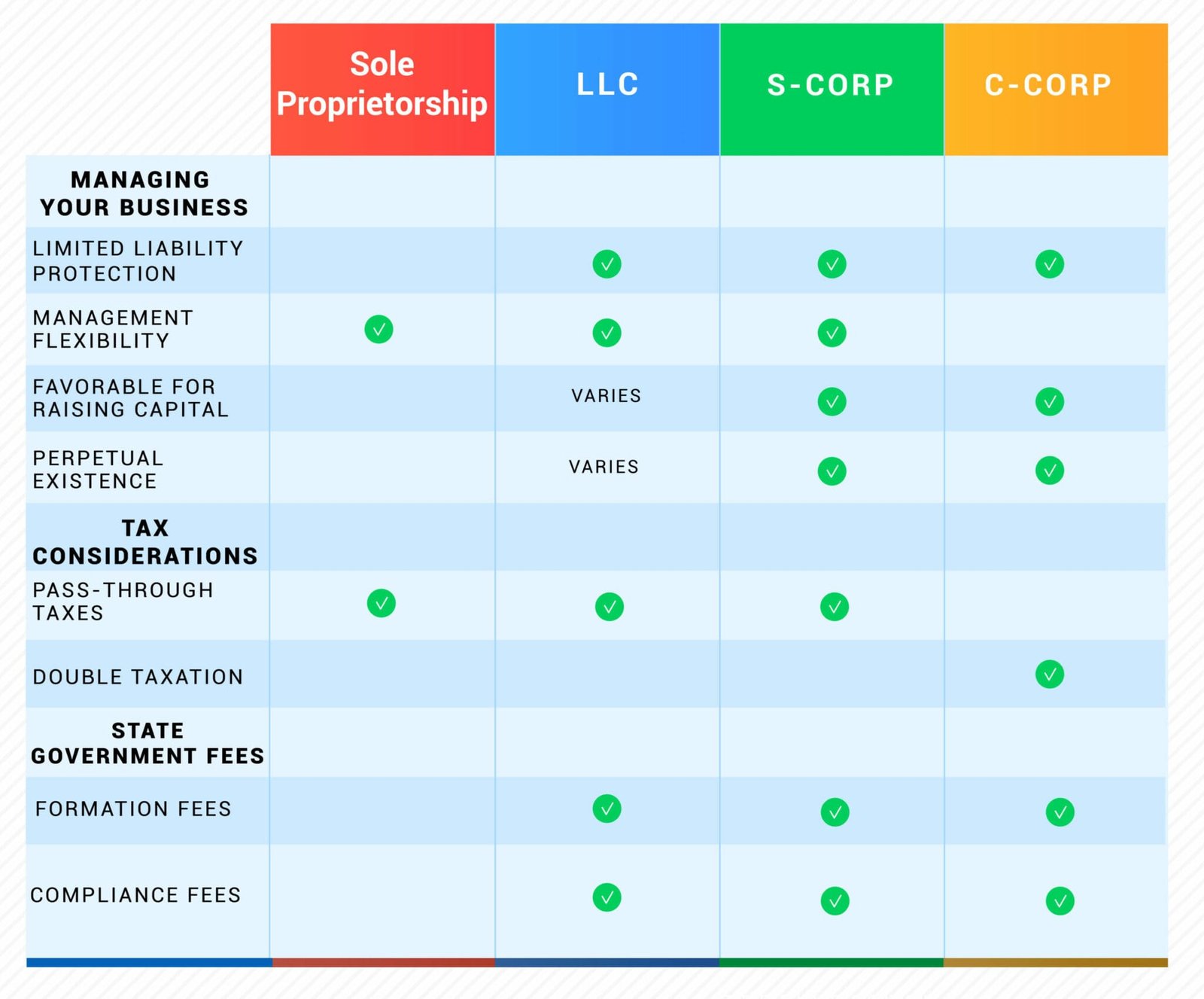

LLC vs Corporation vs Sole Proprietorship

Corporation vs. LLC

A corporation, like an LLC, has liability protection but does not protect its owners against double taxation. C corporation owners are subject to both corporate income tax and personal income tax.

S Corporation vs. LLC

An S corp is not a business entity but a federal tax choice. A C corp or LLC can apply for an S-Corp. This federal tax election protects the owners’ personal assets and avoids double taxes.

Sole Proprietorship vs. LLC

Although it is easy and cost-effective to run a business as a sole proprietor, there is no protection for liability like an LLC. Compare sole proprietorships.

There is a major difference between operating as a sole proprietorship and an LLC. This is because personal assets are kept separate from business. An LLC keeps personal assets separate, while sole proprietors have the same expenses. Your personal assets and property can be taken after a business is sued.

General Partnership vs. LLC

You will be dealing with formalities here. The process of forming an LLC involves many details, including preparing and filing paperwork with the Secretary. It is not necessary to enter into a formal agreement when forming a partnership.

Limited Liability Partnership (LLP vs. LLC)

An LLP is similar to an LLC in that it offers limited liability. However, an LLP gives it more. An LLC protects all members from personal liability for business debts and lawsuits.

An LLP, on the other hand, provides only liability protection for each partner’s direct investment.

______________________________

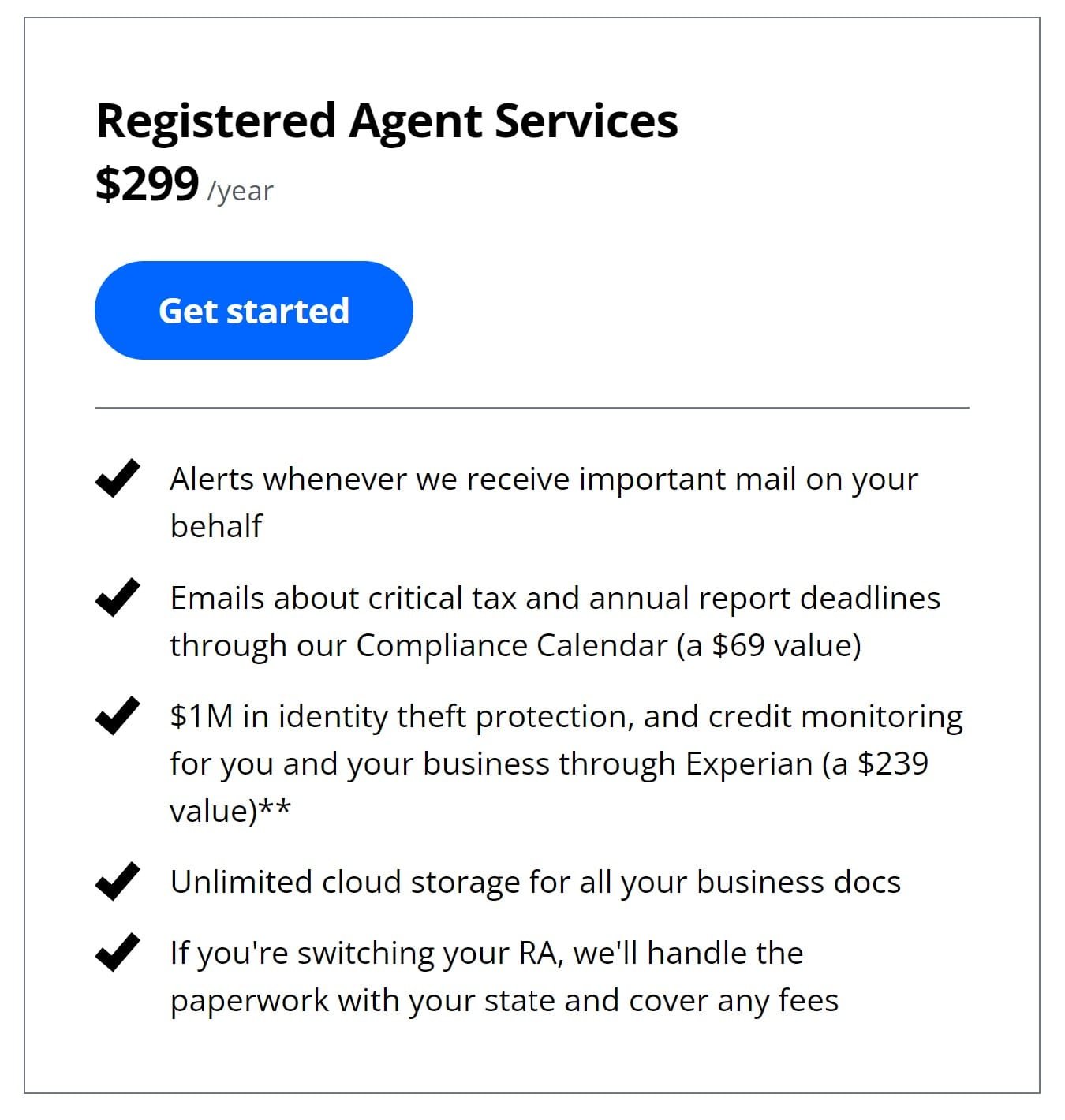

LegalZoom

Strong brand, but pricey!

$0 filing + $299 reg.agent = $299

Extra $50: You get to talk to a lawyer

____________

Registered Agent Service

____________________________

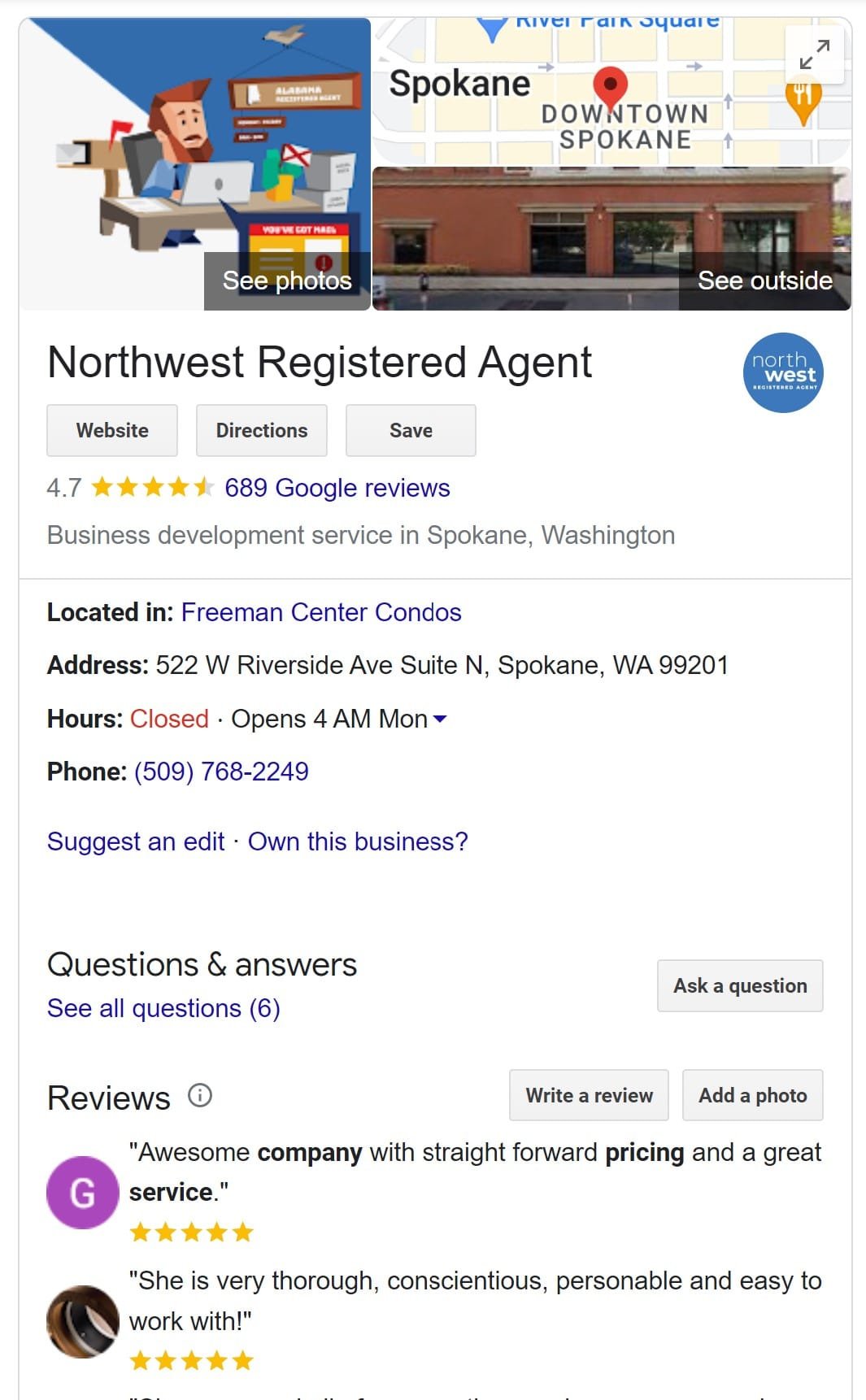

Northwest Registered Agent

Editor’s Choice!

Best LLC Service 2025

$39 LLC Filing, Formation, Registered Agent 😀

900+ Employees, 3 Million Customers

https://www.northwestregisteredagent.com

LLC Formation

Registered Agent 1/yr$225 $39

(Learn How Non-Citizens Can Get an LLC in the U.S. with Northwest, Visit Here)

Visit Northwest

____________

Texas Trucking Business

How to Start an LLC for a Texas Trucking Business

How to Form an LLC – Business Name Search by State

* State fees are subject to change.

Our Top 4 Picks for LLC Formations

If you are starting a new business, finding the right service to organize and file all the necessary documents to create a limited liability company can be difficult.

I think the best approach for most people is to learn the basic guidelines for your state and then find a trusted LLC service that can help you get through the formation process.

A professional and affordable LLC service will save you time and money. The service already knows and understands the LLC formation process in your state.

They can help you fill in the forms, provide guidance, and ensure everything is correct before filing.

By hiring a good LLC service, you can reduce the chance that your LLC filing will be rejected because it is incomplete or incorrectly submitted.

Cost to Form an LLC by State

This table lists the filing fees and the annual fees for each state. Fees are subject to change.

| State | Filing Fee | Recurring State Fees |

|---|---|---|

| Alabama | $200 | $10 Annual Report $100 Annual Privilege Tax (minimum) |

| Alaska | $250 | $100 (every two years) |

| Arizona | $50 (plus publishing costs) | $0 (report due annually) |

| Arkansas | $45 online, $50 by mail | $150 Franchise Tax Report (annually) |

| California | $70 | $800 – Franchise Tax (annually) (Exemptions are available) $20 – Statement of Information (annually) |

| Colorado | $50 | $10 (annually) |

| Connecticut | $120 | $80 (annually) |

| Delaware | $90 | $300 Franchise Tax (annually) |

| Florida | $125 | $138.75 (annually) |

| Georgia | $100 online, $110 by mail | $50 (annually) |

| Hawaii | $50 | $15 (annually) |

| Idaho | $100 online, $120 by mail | $0 (report due annually) |

| Illinois | $150 | $75 (annually) |

| Indiana | $95 online, $100 by mail | Biennial report – $32 online, $50 by mail |

| Iowa | $50 | $60 (biennial report) |

| Kansas | $160 online, $165 by mail | $55 (annually) |

| Kentucky | $40 | $15 (annually) |

| Louisiana | $100 | $30 (annually) |

| Maine | $175 | $85 (annually) |

| Maryland | $100 | $300 (annually) |

| Massachusetts | $500 | $500 (annually) |

| Michigan | $50 | $25 (annually) |

| Minnesota | $155 online, $135 by mail | $0 (report due annually) |

| Mississippi | $50 | $0 (report due annually) |

| Missouri | $50 online, $105 by mail | $0 |

| Montana | $70 | $20 (annually) |

| Nebraska | $100 online, $110 by mail | $10 (biennial report) |

| Nevada | $75, plus $150 for the initial list of officers | $150 Annual List of Members & Managers |

| New Hampshire | $100 | $100 (annually) |

| New Jersey | $125 | $75 (annually) |

| New Mexico | $50 | $0 |

| New York | $200 (plus publishing costs) | $9 (biennially) |

| North Carolina | $125 | $200 (annually) |

| North Dakota | $135 | $50 (annually) |

| Ohio | $99 | $0 |

| Oklahoma | $100 | $25 (annually) |

| Oregon | $100 | $100 (annually) |

| Pennsylvania | $125 (plus publishing costs) | $70 (decennial report) |

| Rhode Island | $150 | $50 (annually) |

| South Carolina | $110 | $0 |

| South Dakota | $150 online, $165 by mail | $50 (annually) |

| Tennessee | $300 (minimum) | $300 (minimum) |

| Texas | $300 | $0 report Franchise Tax |

| Utah | $70 | $20 |

| Vermont | $125 | $35 (annually) |

| Virginia | $100 | $50 (annually) |

| Washington | $200 | $60 (annually) |

| West Virginia | $100 | $25 (annually) |

| Wisconsin | $130 online, $170 by mail | $25 (annually) |

| Wyoming | $102 online, $100 by mail | $50 minimum (annually) |

* State fees are subject to change.

Best LLC Formation Services – Our Top 4 Picks for 2025

Top 4 Best LLC Services

#1 Northwest Registered Agent $39

https://northwestregisteredagent.com

- Editor’s Choice

- Best for Privacy

(Learn How Non-Citizens Can Get an LLC in the U.S. with Northwest, Visit Here)

#2 Bizee

#3 ZenBusiness

#4 LegalZoom

If you plan to start a new business soon or if you are shopping for an LLC service to assist you, this website is for you.

4 Reasons to Hire a Good LLC Service:

- They can save you time

- They know the formation process and compliance requirements in your state

- Most are affordable

- By hiring a good LLC service, you can reduce the chance that your LLC filing will be rejected because it is incomplete or incorrectly submitted